Hourly wage plus tips calculator

Table of Minimum Hourly Wages for Tipped Employees by State. Multiply the hourly wage by the number of hours worked per week.

Tip Tax Calculator Primepay

GetApp has the Tools you need to stay ahead of the competition.

. An easy formula for estimating your equivalent annual salary is to double your current hourly wage and add three zeros to that number. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. For example if an employee earns 1500.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. What is Hourly Wage. If calculating withholding taxes on tips sounds complicated to you dont worry.

To convert your hourly wage to its equivalent salary use our calculator below. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. Then multiply that number by the total number of weeks in a year 52.

How to calculate annual income. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. See where that hard-earned money goes - Federal Income Tax Social Security and.

Go To Stock Option Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculator that will allow you to do real-time stock lookup to determine gain from selling stock and taxes owed.

These figures are pre-tax and. For instance in case the hourly rate is 1000 and someone works 4 extra hours over the standard time of 8 hours a day his daily wage will be. Ad See the Paycheck Tools your competitors are already using - Start Now.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Basic Combined Cash Tip Minimum Wage Rate. 1000 8 8000 Overtime.

Formula to estimate annual salary. - In case the pay rate is hourly. Hourly wage refers to the amount of money you are paid for every hour of work you perform.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. All other pay frequency inputs are assumed to be holidays and vacation. Heres a step-by-step guide to walk you through.

A Hourly wage is the value. And as long as they earn more than 20 in tips a month you are required to take out withholding taxes. For example if an employee makes 25 per hour and.

On the other hand salary is the fixed amount of money you are paid over a. Maximum Tip Credit Against Minimum.

Wage Calculator Convert Salary To Hourly Pay

How To Charge Your Freelance Clients Plus A Bonus Hourly Rate Calculator Online Jobs Photography Jobs Freelance Web Design

Attention Artists Need Help Calculating Your Commission Prices How Are You Feeling Helpful Job Interview Tips

Free Tip Tax Calculator

How To Charge Your Freelance Clients Plus A Bonus Hourly Rate Calculator Online Jobs Photography Jobs Freelance Web Design

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Wages 14 Steps With Pictures Wikihow

Labor Rate Calculator Servicetitan

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

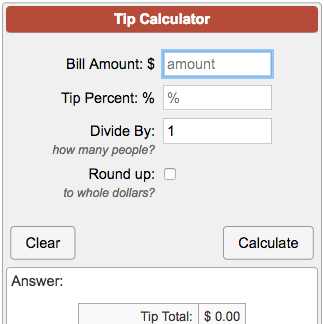

Tip Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator